Product terms

Loan size

50.000₮ – 5.000.000₮

Loan period

7, 14, 21, 30 days

Interest rate

2.99% – 4.50%

Service fee

2500₮

| Loan amount | 50,000₮ – 5,000,000₮ |

|---|---|

| Loan purpose | Consumer loan |

| Loan duration | 7, 14, 21, 30 days |

| Interest rate | 2.99% – 4.50% |

| Overdue interest rate | Equal to 20% of the basic interest |

| Service fee | 2500₮ |

| Repayment | At the end of the term |

| Collateral | Unrequired |

Guide video

- 1. Must be an 18-year-old citizen of Mongolia

- 2. Must have received regular income for the last 6 months or more

- 3. Send the bank account statement from which the income is received and calculate your credit line eligibility

- 4. Must have no overdue loan balance or history in the Credit database

- 5. Must have sufficient debt-to-income ratio to repay the loan

GET DIRECTIONS

LOCATE YOUR GEOPOSITION

Description

What are the features and advantages of LendMN?

- No collateral is required

- You can easily solve your financial needs whenever you want

- Flexible interest payment terms for the period of use

- You can get repeated loans as many times as you want during the validity period of the credit

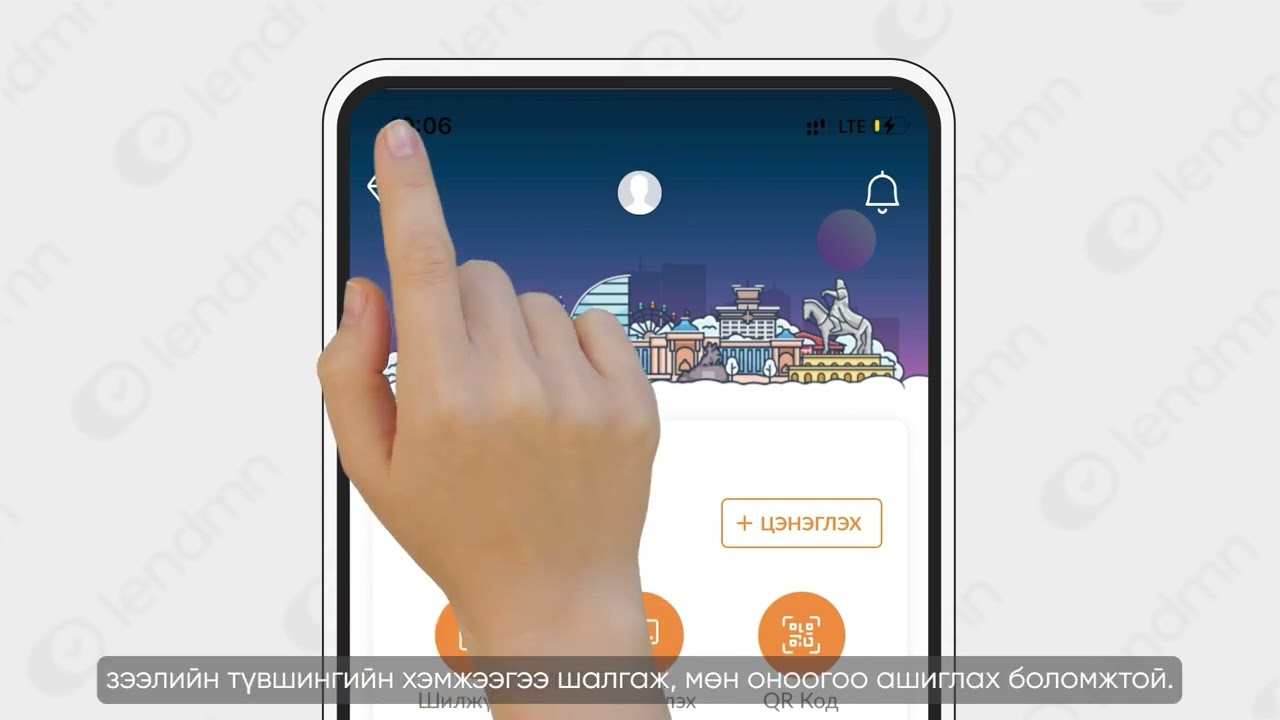

- Reward points are awarded for making repayments on time

- Bonus points can be used to increase the credit or reduce the interest rate.

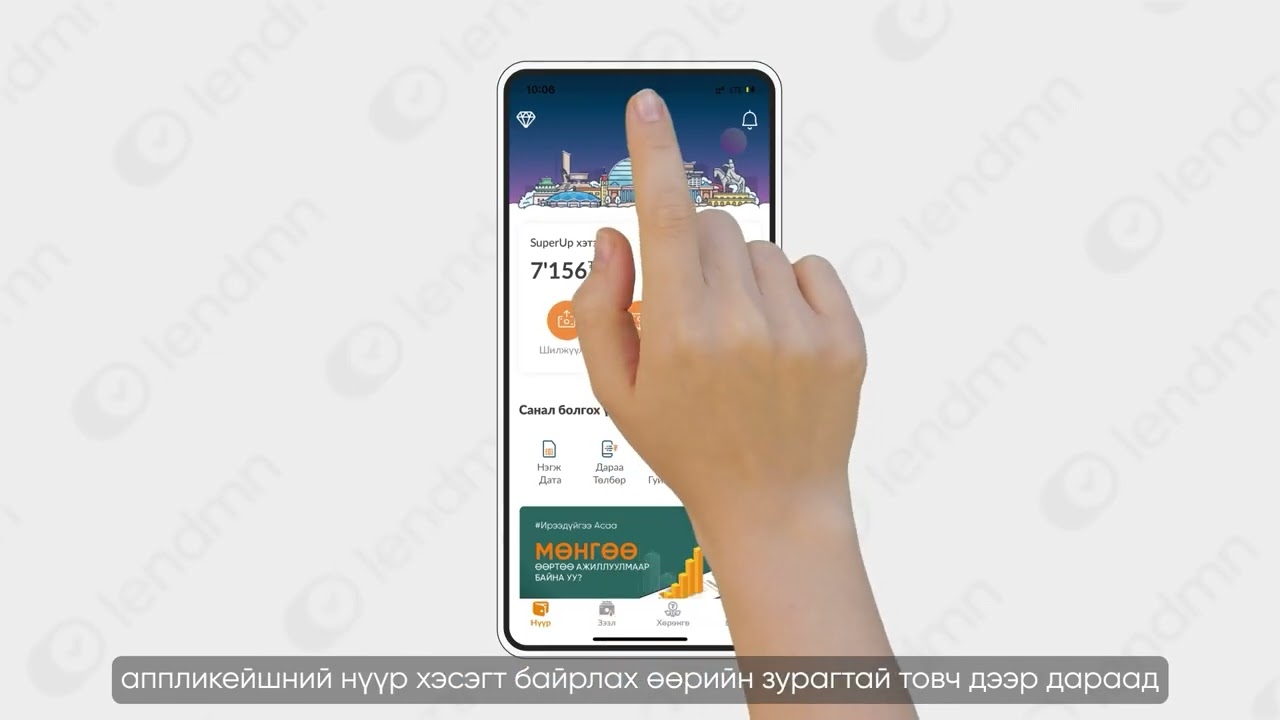

How to download the LendMN application?

You can download the application by searching for LendMN in the App Store or Play Store on your smartphone.

What are the requirements for a loan?

- Must be an 18-year-old citizen of Mongolia

- No past due loan balance or history in the credit database

- You must have sent an account statement that received regular income for the last 6 months or more

- The level of debt-to-income ratio should be sufficient to repay the loan

What documents are required to conclude a contract?

- Identity card

- ID reference

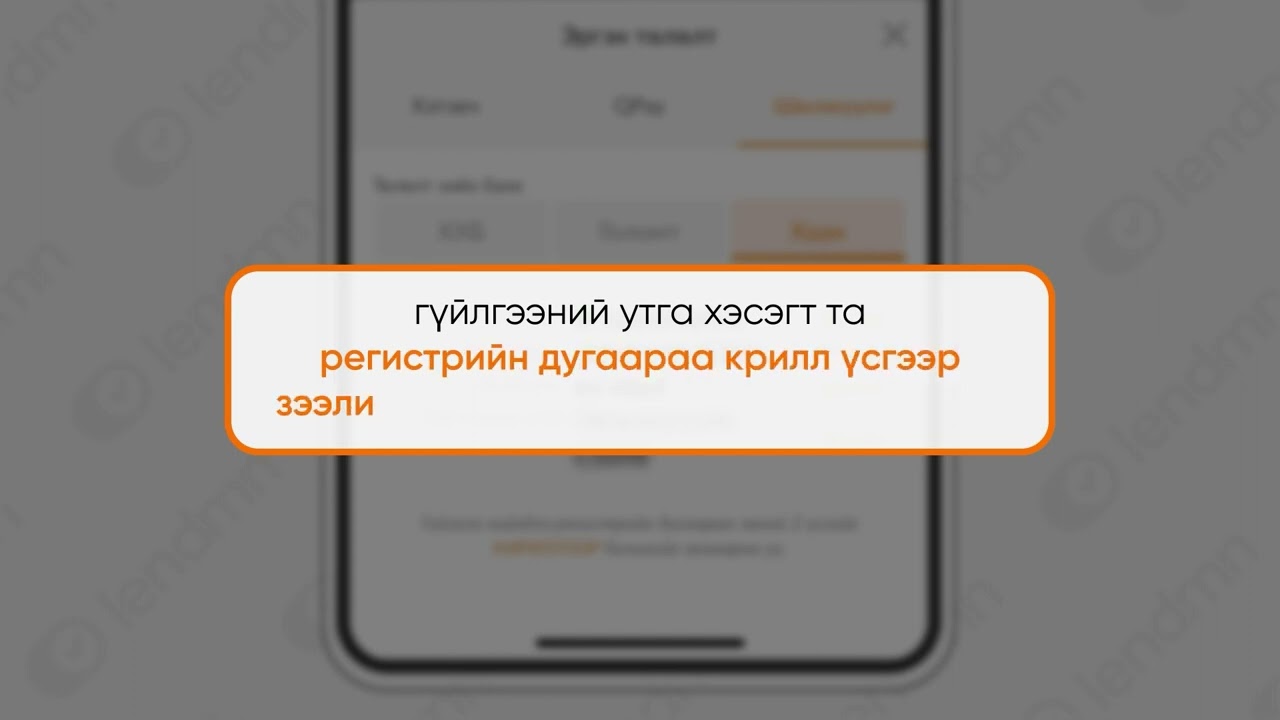

How to get a loan?

- Register as a user in the application

- Download the LendMN app, fill out your information, and submit your checking account statement to apply for a loan.

- Establishing a contract

- In case of credit rights, you can get a loan by choosing a customer service center or a notary nearest to you and signing a contract.

Is it necessary to sign the contract in person? Where is the contract point?

- Sign the contract in person at the head office of “LandMN BBSB” JSC in Ulaanbaatar city, Chingeltei district, 3rd district, Suvd center or the nearest notary.

- The location of a notary where a contract can be concluded can be found in the LendMN application and by calling 7707-0101.

How are bonus points calculated?

- Every time you repay the loan on time, you get bonus points by multiplying the loan days by 10.

For example: if you take a 30-day loan and pay it back on the 30th day, you will get 30×10=300 points, and if you pay on the 25th day, you will get 25×10=250 points. - Bonus points are not awarded in the following cases.

- When the loan is overdue

- In case of repeated credit periods, the first credit score will be entered in full, and the next credit score will be included

Why are internet bank login and password required?

- The purpose of obtaining your bank login and password is to calculate credit eligibility through bank statements, saving you time by automating the process of manually fetching bank statements.

- Also, this account connection is a one-time system-level operation without human intervention to determine your income, and your bank details are not stored.

How to pay the loan?

- You can pay your loan repayments by logging into the application, and you can also make payments to the following LandMN accounts:

- Trade and Development Bank: account number 460020642

- Golomt bank account number: 1505119229

- Khan Bank: Account No. 5220042965

Is it possible to extend the term of the loan?

Extension is possible when your loan balance is over MNT 50,000. When you extend your loan term, you pay a total amount equal to 10% of the accrued interest, fees, and principal.

What if the loan repayment period is overdue?

- If your loan is overdue, your access to the service will be suspended until repayment is made and no bonus points will be awarded.

- Furthermore, your delinquent loan information will be recorded in the Credit Database as a downgraded loan. Please note that there is a risk of not being able to get credit services from other banks and financial institutions.

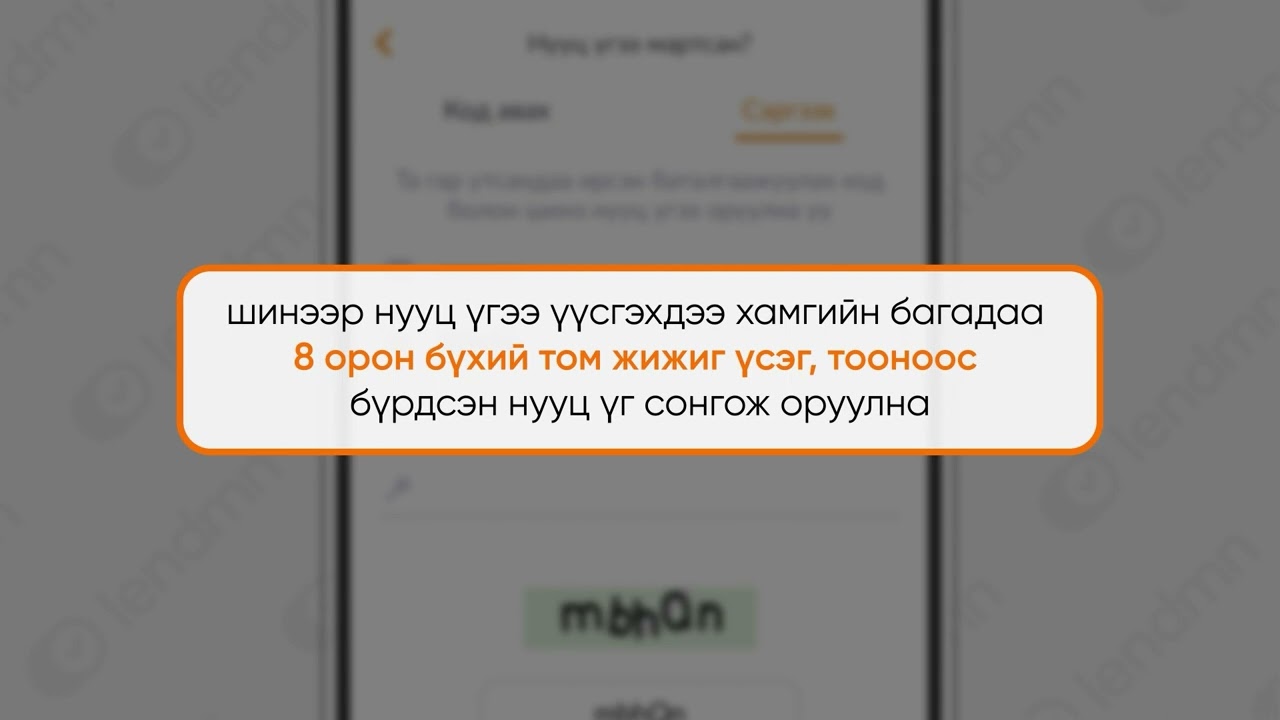

What if I forget my password in the application?

You can reset your password using your registered email and phone number by selecting the ‘Forgot Password’ menu on the login screen of the application.

Product

terms

Loan size

Loan period

Payment is made once a month

Interest rate

3.51% – 3.99%

| Loan amount | 5,000,000₮ – 50,000,000₮ |

|---|---|

| Loan purpose | Consumer loan |

| Loan duration | Payment is made once a month |

| Interest rate | 3.51% – 3.99% |

| Overdue interest | None |

| Service fee | None |

| Collateral | Unrequired |

Guide video

- 1. Must be an 18-year-old citizen of Mongolia

- 2. Must have received regular income for the last 6 months or more

- 3. Send the bank account statement from which the income is received and calculate your credit line eligibility

- 4. Must have no overdue loan balance or history in the Credit database

- 5. Must have sufficient debt-to-income ratio to repay the loan

GET DIRECTIONS

LOCATE YOUR GEOPOSITION

Description

What is Flexi ?

Харилцагч Танд өөрийн санхүүгийн хэрэгцээг хүссэн үедээ хялбараар шийдэх боломжийг олгохоор ЛэндМН-ийн зүгээс санал болгож буй илүү урт хугацаа, уян хатан төлөлтийн нөхцөл бүхий цоо шинэ зээлийн бүтээгдэхүүн юм.

FLEXI зээл нь Таны авч ашиглах боломжтой зээлийн эрх болон хугацааны дээд хэмжээг тодорхойлж, тус хэмжээний дотор олон давтамжтайгаар зээл авах, эргүүлэн төлөх буюу зээлийн шугам хэлбэрээр ашиглах боломжийг Танд олгох болно.

1.1 FLEXI зээлийн гол нөхцөл юу вэ?

- Зээлийн эрхийн хэмжээ: 5 сая – 50 сая төгрөг

- Зээлийн үндсэн хүү (сараар): 3.99% (хэрэв хугацаандаа эргэн төлбөл тухайн сарын хүү буурч 3.51% болох боломжтой)

1.2 FLEXI зээлийн ОНЦЛОГ юу вэ?

- Зөвхөн танд зориулсан зээлийн шугам

- Зээлийн хэмжээ өндөр тогтох боломжтой

- Зээлийн шугамаа тогтмол ашиглаж, олон давтамжтай зээл авах боломжтой

- Уян хатан төлөлтийг урт хугацаанд хийх боломжтой

- Хугацаандаа хийсэн төлөлтөд хөнгөлөлттэй хүү ашиглах эрхтэй

- Сард 1 удаа, өөрийн сонгосон өдөр эргэн төлөх боломжтой

- Зээл олголтын шимтгэл, торгуулийн хүү байхгүй

How to get Flexi Loan?

Та анх удаа FLEXI зээл авах гэж буй бол дор дурдсан үйлдлүүдийг гүйцэтгэснээр зээл авах боломжтой:

4.1. Та өөрийн тогтмол орлого хүлээн авдаг банкны дансны хуулгаа илгээж, FLEXI зээлийн шугамын эрхийг LendMN аппликейшнд автоматаар тооцуулна.

4.2. Цахимаар FLEXI зээлийн гэрээ байгуулах

4.3. Зээлийн хэмжээ, сар бүр зээл төлөх өдрөө 1 удаа сонгох

4.4 Зээл эргэн төлөх хуваарьтай танилцах

4.5. Цахимаар FLEXI зээлийн гэрээний хавсралтыг баталгаажуулах

Та FLEXI зээлийн шугамаа үргэлжлүүлэн ашиглах буюу зээлийн хэмжээгээ нэмэгдүүлэх тохиолдолд тухай бүр зээл эргэн төлөх хуваарьтай танилцаж, гэрээний хавсралтаа баталгаажуулахад хангалттай.

When to pay?

FLEXI зээл нь сардаа 1 удаа, өөрийн сонгосон зээл төлөх өдөртөө эргэн төлөх нөхцөлтэй байна.

5.1. Зээл эргэн төлөх өдрөө хэрхэн тодорхойлох вэ?

- Та FLEXI зээлийн шугамаа ашиглан анх удаа зээл авах үед сар бүрийн зээл эргэн төлөх өдрөө 1 удаа сонгох шаардлагатай.

- Таны сонгосон зээл эргэн төлөх өдөр нь зээл эргэн төлөх хуваарьт тусаж, баталгаажна.

5.2. Зээл эргэн төлөх өдрөө өөрчлөх боломжтой юу?

- Та зээл эргэн төлөх өдрөө өөрийн авсан зээлээ бүрэн эргүүлж төлөх хүртэл дахин өөрчлөх боломжгүй болохыг анхаарна уу.

5.3. Зээл эргэн төлөх хуваарь гэж юу вэ?

- Та FLEXI зээлийн шугамаа ашиглах бүрд таны ашиглаж буй зээлийн үлдэгдлээс шалтгаалан тооцогдсон, зээл эргэн төлөх өдөр хэдий хэмжээний зээлийн төлбөрийг ямар хугацаанд төлөх мэдээллийг агуулсан хуваарь юм.

- Та FLEXI зээлийн шугамаа ашиглах бүрд зээл эргэн төлөх хуваарьтай танилцаж, баталгаажуулна.